The policy-driven market regime

The policy-driven market regime

A dominant market regime always dictates financial asset prices. The regime may be driven by a macroeconomic factor (e.g., inflation), monetary policy, structural market shift (e.g., technological disruption), or other forces. Identifying the prevailing market regime is critical for effective portfolio management, as it focuses attention on what truly matters at any given point, cutting through noisy headlines.

Unlike with emerging economies, political developments rarely define a regime in developed countries, unless tied to tangible economic factors (e.g., a major tax cut). However, the recent election and the emerging policy framework—which seems poised to be transformational rather than incremental—may shape such a regime. Our investment team has been closely analyzing the potential implications this could have on various asset prices.

While many factors remain uncertain, and it is too early to determine how much of the new administration’s agenda will materialize, three trends appear likely in the early years: deregulation, reshoring, and increased scrutiny on government expenditure. Companies’ alignment with these trends could heavily influence stock performance, potentially eclipsing short-term earnings trends or other market factors.

Deregulation

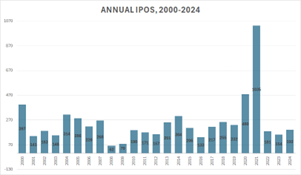

Who stands to benefit most from deregulation? Investment banks are an obvious winner, with the potential resurgence of mergers and acquisitions (M&A) activity, which has been subdued for three years, partly due to a stringent antitrust environment (Chart A). Similarly, alternative asset managers such as private equity firms and oligopolistic industry structures that have faced heightened scrutiny from consumer protection agencies (e.g., airlines) are also expected to benefit.

Chart A: Annual IPOs, 2000-2024

The crypto industry has already experienced strong price action since the election, reflecting optimism over the incoming administration’s openness to blockchain integration into mainstream finance and the establishment of clear regulatory frameworks that will encourage more institutional participation. Fintech companies, too, may benefit from a more restrained Consumer Financial Protection Bureau (CFPB), fostering more partnerships between fintechs and banks.

In the energy sector, the administration’s commitment to rising domestic production presents mixed implications. While increased production could lower prices, companies focused on volume rather than price—such as service providers or pipeline operators—stand to benefit.

Reshoring

Reshoring is less of a new trend and more a continuation of an existing trajectory. Over the past eight years, domestic manufacturing has experienced a resurgence in the United States, driven by reshoring and foreign direct investment (FDI). This trend accelerated during the Biden administration due to the two signature laws, the Inflation Reduction Act (IRA) and CHIPS and Science Act. Industrial, infrastructure, and transportation companies with predominantly US manufacturing footprints have benefited—and will continue to do so.

Chart B. US Construction Spending on Manufacturing

Source: Census Bureau, Haver Analytics

Government Spending Scrutiny

Deep cuts in government spending, even a fraction of the proposed $2 trillion target, could dramatically affect certain industries. Defense and healthcare—together accounting for 40% of government expenditures—are particularly vulnerable.

In defense, irrespective of geopolitical developments, there is discussion about improving efficiency and replacing legacy systems with disruptive, tech-enabled solutions. This shift poses significant risks for traditional defense contractors like Lockheed Martin. In healthcare, potential targets include drug pricing and high-cost delivery models. Packaged food companies could also be targets by the Department of Health and Human Services (HHS), which has promised a crackdown on things like sugar and artificial additives.

Government contractors in sectors like waste disposal, education, facility management, and infrastructure may face heightened scrutiny around contract terms, which could impact operations.

Implications for other industry sectors and regions

Although deregulation and a growth-oriented policy mindset can be broadly helpful for all other sectors, there are some offsets related to potential disruption in global trade due to the proposed tariffs. For example, the semiconductor industry, which is currently riding on a lot of optimism related to artificial intelligence, is particularly vulnerable to tariffs due to the industry’s complex, globally integrated supply chains.

Regionally, the consensus is for US equity markets to outperform the rest of the world, with Mexico, China, and Europe particularly vulnerable. This outperformance is rational, although in the case of China, it will likely trigger a large domestic stimulus effort by the Chinese government—6% of GDP has already been announced in the form of debt assistance to local governments, but a second wave could follow early next year, targeted towards domestic consumption.

In summary, we believe the policy impact will be felt less on the broader economy—deregulation is stimulative, but severe cuts in government spending could dampen overall demand. The impact will likely be more pronounced at the sector and company level, with effects ranging from strongly positive to strongly negative. For investors, this regime presents opportunities to identify winners and losers by assessing how individual companies align with the new policy trends.

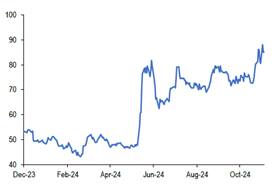

We have developed a custom equity basket that goes long on companies positioned to benefit from the new policy framework while shorting those deemed vulnerable. Chart C shows how the long policy portfolio is significantly outperforming since the election.

Chart C. Custom Equity Basket Based on Policy-Driven Market Regime

Source: Bloomberg

Interesting Things We are Noticing

Rate Cuts and Rising Yields: Since the Federal Reserve cut rates on September 18, both the 10-year Treasury yield and the 30-year mortgage rate have risen by approximately 40 basis points. While inflation has moderated, history suggests that cutting rates too soon after a significant inflationary episode can rekindle upward pricing pressures. With the new administration’s pro-growth stance, there is a risk that inflation could reaccelerate, disappointing those hoping for relief on borrowing costs—such as highly leveraged corporations and homeowners with adjustable-rate mortgages.

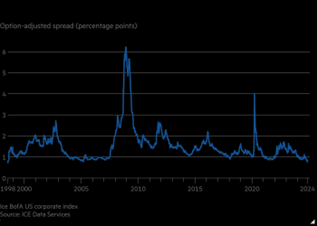

Compression in Bond Spreads: U.S. high-grade bond spreads—the difference between yields on high-grade bonds and U.S. Treasury yields of comparable maturity—are at their lowest levels in 27 years. Meanwhile, high-yield bond spreads are at their lowest in 17 years. This could signal either a strong outlook for the U.S. corporate sector, with a low probability of liquidity issues, or a reassessment of the risk-free nature of government debt due to high debt-to-GDP levels and persistent budget deficits. At current spreads, high-yield bonds and leveraged loans offer limited value, in our view.

Chart D. High grade bond spreads

Source: Bloomberg

Government-Driven Employment and Growth: Government and healthcare jobs have been the largest contributors to employment growth over the past year, while government spending has disproportionately fueled GDP growth in recent quarters. This dynamic suggests two key insights: first, that the underlying private sector economy may be weaker than headline figures imply; and second, that the broader economy faces added risk if the proposed government efficiency measures result in abrupt and deep spending cuts.

US Equity Market Outperformance: Over the past 15 years, U.S. equity markets have dramatically outperformed international equities, especially when measured in dollar terms. Chart E highlights the relative performance of the S&P 500 versus the MSCI World ex-U.S. It has been a steady upward trend, with the S&P 500 outperforming in 12 out of the past 15 years, for a total return that is over 2.5 times greater than that of the MSCI World ex-U.S. The contrast is even starker when compared to emerging markets, where dollar-denominated indices have delivered minimal capital appreciation, with most returns coming from dividends. A principal driver of this outperformance has been the dominance of the U.S. technology sector during an era defined by technological disruption. However, the valuation divergence has been striking, with a recent Financial Times opinion piece noting, “In the past, including the roaring 1920s and the dotcom era, a rising US market would lift other markets. Today, a booming US market is sucking money out of the others.”

Chart E. US Equity Market Outperformance

Source: Bloomberg

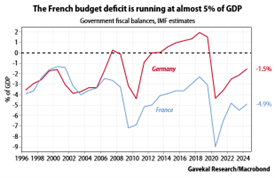

Towards a French Budget Crisis? The 10-year French-German bond yield spread recently hit 90 basis points, with French yields now on par with Greece’s. In recent years, France’s budget deficit has continued to worsen, even as Germany has tightened its belt (Chart F). The remedy requires a tightening of the public purse strings, which is difficult to do in a fragmented parliament, or tax rises that could trigger a further exodus of capital, as France is already the most taxed economy in the OECD. France’s central role in the European Union makes this a critical situation to monitor.

Chart F. France-Germany credit spread & French Budget Deficit

Source: Gavekal Research

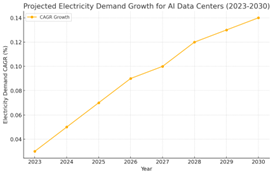

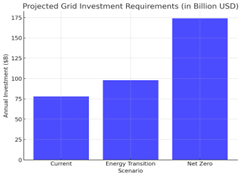

Powering AI – Implications of Rising Energy Demand: The expansion of artificial intelligence (AI) applications is driving a sharp rise in electricity demand, particularly from AI-focused data centers. These GPU-powered facilities consume significantly more electricity than traditional data centers and demand advanced cooling systems to handle heat. Their energy needs can rival those of small cities, making infrastructure expansion critical to ensure reliable power delivery and efficient management.

We anticipate this will be a compelling investment theme in the coming years. The grid, originally designed for centralized, one-way power flows, must be modernized to integrate renewable sources and advanced transmission systems. The investment needed for this transformation is staggering, with projections suggesting that annual grid spending in the U.S. could grow by as much as 120% (Chart G). Nuclear energy, particularly advancements in nuclear fission technology, could offer a critical solution to this energy challenge, providing stable carbon-neutral energy supply with high reliability.

We have been tracking this theme with another custom equity basket (Chart H) that includes companies at the forefront of grid modernization, such as Quanta Services and Eaton, select utilities, and nuclear modular reactors and equipment, and other related sectors.

Chart G. Projected Electricity Demand Growth & Investment Requirements

Source: Bernstein

Chart H. Custom Equity Basket Based on AI-Driven Power Demand

This document has been provided to you solely for information purposes and does not constitute an offer or solicitation of an offer, or any advice or recommendation, to purchase any securities or other financial instruments, and may not be construed as such. Historical performance shown for the baskets is for informational purposes only and does not represent the performance of an investment fund or any specific client account.